Why does one walk into a restaurant and order the same thing they had last time, fly with the same airline or by a particular brand of toothpaste? Familiarity, loyalty and an understanding of the performance or ‘potential performance’ of the product or service offering.

Investors behave no differently, except for one key factor. As the GFC proved, nothing was immune to market distribution, innovation or collapse. Sure, equity markets can gain back losses over time, real estate markets can rebuild, but considering how much more is at stake with an investment, rather than the performance of toothpaste, there is a lot more to be considered.

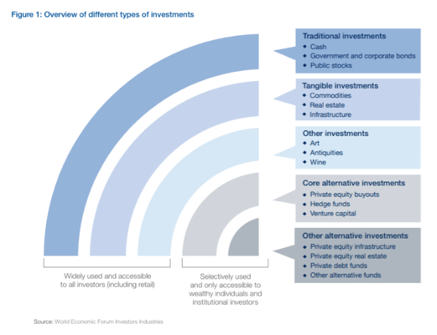

One of the key differentiators between traditional markets and alternative investment markets is the ‘access’ at which investors have to each of the investment categories discussed. For example, with a tax file number (TFN) and a bank account, most major banks have an online trading platform that they are all too happy to guide new investors through getting their CHESS number (Clearing House Electronic Sub-register System), upload funds and start making trades.

Whereas to access a hedge fund or debt facility fund, there are minimum hurdle rates that one must be able to often prove and have their accountant sign off on in order to invest the funds. For example, a term that will be used often throughout this document is that of the ‘sophisticated investor’.

Within Australia – and most equivalent capital markets for that matter – by definition a sophisticated investor must be able to invest a minimum $250,000 into a fund or investment scheme, while also holding $2.5 million in assets. This would make them highly ‘liquid’ as individuals, and in many ways in the top 10-15% of all Australians.

Although there are other ‘funds’ available for investment on the ASX (Australian Stock Exchange) for as little as $250 minimum investment, traditional investments were the only ones within the grasp of many investors from all over the world.

With the world experiencing “historically low-interest rates and the enduring effect of quantitative easing are making markets expensive, investors continue to turn to alternative asset classes.

Furthermore, changes in how we work and live, prompted by new technology, innovative business models, geopolitical shifts and emerging lifestyle choices, could render many real assets obsolete while creating opportunities elsewhere.”[3]

The key differences between traditional and alternative investments are outlined below.

Liquidity

Traditional investments are often more attractive to new investors or those with a low-risk tolerance, due to the fact they are highly liquid. In other words, they can be sold or moved on very quickly for cash. Meanwhile, alternative investments often ‘tie up cash’ for set periods of time – as set out in the prospectus documents or information memorandums – or are harder to move on for investors.

This is often due to the more specialised nature or requirements of the funds by the fund or asset managers of alternative investments, vs. managers of traditional assets, which can be easily bought and sold on the ASX or through traditional market vehicles.

Information and Support

Traditional investors are often very guarded about their ‘trade secrets’ or ‘tricks of the trade’ in how they made their money. Whereas alternative investment managers often provide too much information for the average investor to comprehend. This includes training courses, information memorandums, feasibility studies, investment seminars and more.

The level of involvement or support from managers is often specific to their asset class and business model, however alternative investments often provide far more transparency in their dealings with both new time and seasoned investors.

Return on Investment

Undoubtedly “the money shot” or the biggest difference between traditional and alternative investments is that of Return on Investment (ROI). Alternative investments as a ‘general rule’ provide significantly higher returns on investment than that provided by traditional investment classes.

This in large part is due to the associated ‘risk’ of alternative investments, however, it must also be noted that even in tough economic times, alternative investments often thrive. In fact, many alternative investments are created and geared to do just that. When traditional investments are suffering losses – such as during the 2008 Global Financial Crisis – alternative asset classes thrive.

Many alternative assets as mentioned are designed to do exactly that, such as hedging vehicles for investor’s asset portfolios. As they often require a smaller investment to realise significant returns should their conditions be met for a ‘payout’ scenario on the alternative.

With financial products, there are risks of losses, and should you or your fund manager take a leveraged position or trade in leveraged financial products (such as derivatives), your losses could exceed your initial investment.

[3] PWC (2018) “Rediscovering alternative assets in changing times”

.png?width=230&name=logo%20(3).png)